The funds trade is obscure, even for practitioners. My 3-part collection on bank card processing hopefully demystified the jargon, pricing fashions, and charges.

This put up will clarify service provider accounts.

It’s regular to be confused about fee processing, gateways, and service provider buying. The trade arguably depends on confusion to levy fees that will in any other case be contested.

As with card processing, understanding how service provider account charges are created and charged will assist you to select the most effective service provider account supplier for your small business.

Service provider Buying

“Acquirer,” “service provider acquirer,” and “buying financial institution” consult with the identical factor: a monetary establishment that has been registered and accredited by a number of of the cardboard manufacturers (Visa, Mastercard, Uncover, American Specific) to just accept card funds on behalf of a service provider.

Many acquirers are banks, however not all the time. Some non-banking monetary establishments have turn out to be acquirers, and a few unbiased organizations that work on behalf of acquirers name themselves acquirers.

Many acquirers are banks, however not all the time.

An acquirer can carry out a number of features. Some carry out the entire following; others just a few.

- Advertising and marketing and gross sales. Acquirers are companies with prospects — retailers, on this case. Acquirers market their providers and have interaction in gross sales actions to enroll retailers.

- Underwriting. Buying banks primarily present loans to their service provider prospects. The banks should consider the borrower and implement risk-mitigation methods, as with all mortgage.

- Create and handle service provider accounts. A service provider account isn’t a financial savings or checking account. Relatively, it’s a particular kind of checking account that quickly holds the proceeds of bank card and debit card funds.

- Work together with fee processors. This perform creates a lot confusion. An acquirer isn’t essentially a fee processor. Nevertheless, acquirers can provide many providers, together with fee processing. For instance, Financial institution of America Service provider Companies gives each service provider accounts (buying) and fee processing. Some acquirers have partnered with a number of suppliers (e.g., processors, fee gateways, point-of-sale tools) to supply a single answer for retailers.

- Authorize transactions. Service provider acquirers additionally take part in authorizing (approving and declining) fee transactions. Though different organizations additionally approve transactions (processors, card manufacturers, and issuing banks), the acquirer has the ultimate approval. Right here’s the way it works.

When a buyer purchases with a bank card, the fee gateway (supplied by the fee processor) sends the transaction to the cardboard model (e.g., Visa). Earlier than that, nonetheless, the processor usually checks for fraud and gives preliminary approval. The cardboard model verifies the transaction (once more, normally a fraud verify) and, if accredited, passes to the issuing financial institution (supplied the bank card to the paying buyer), which verifies the cardholder’s account has adequate funds. If sure, the issuer approves after which notifies the service provider acquirer. The acquirer, once more, has the ultimate say: deposit funds into the service provider’s account or decline the transaction.

The acquirer carries the monetary threat. If it approves a transaction that later seems to be invalid (normally, a chargeback), the acquirer should refund the issuing financial institution, which can then reimburse the cardholder. Deposits to service provider accounts come from the acquirer, not from the issuing financial institution. Thus deposits to service provider accounts are like short-term loans from the acquirer to the financial institution.

- Arbitrate disputes. When a service provider fails to offer the shopper with the products or providers as promised, it’s the acquirer who’s financially accountable. That is true for chargebacks and for retailers that exit of enterprise (or disappear) with out fulfilling orders. For chargebacks, the acquirer will withdraw funds from the service provider’s service provider account, if the service provider has not vanished. However typically chargebacks are levied incorrectly. Clients could be fallacious or fraudulent. Accordingly, acquirers provide dispute administration, arbitration, and backbone providers.

Service provider Accounts

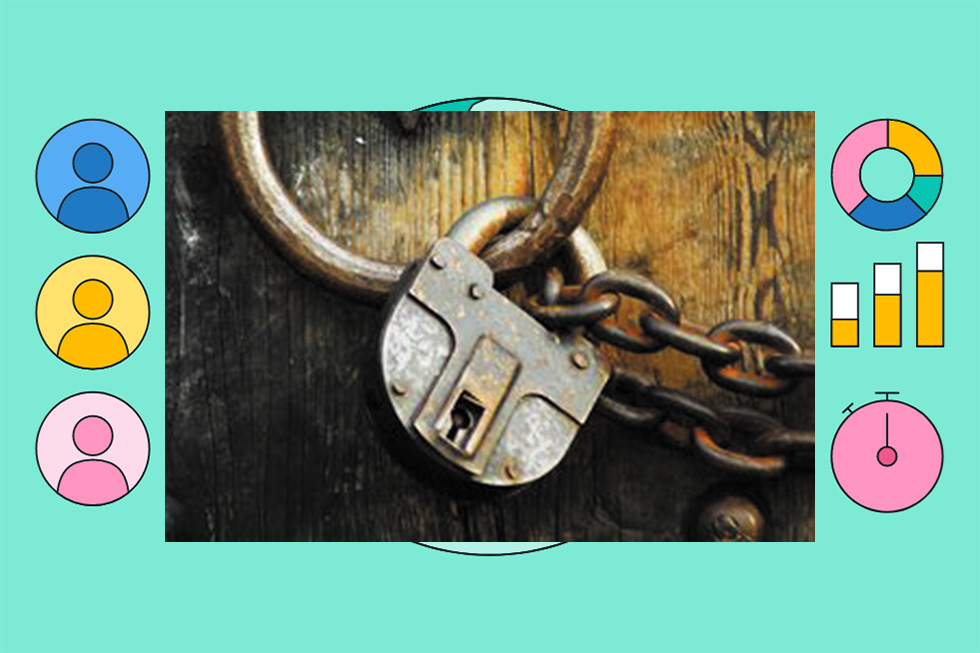

Card manufacturers is not going to enable anybody to just accept bank card funds with out a service provider account.

A service provider account quickly holds the proceeds of credit score and debit card transactions. It’s, once more, a sort of checking account, but it surely’s not a financial savings, checking, or money-market account. A service provider account can’t be used to pay bills, fund payroll, and so forth.

After it approves a credit score or debit card fee, the acquirer will deposit the proceeds, minus the processing charges (interchange, assessments, and markup) into the service provider account. Every buying financial institution has its personal deposit schedule. Some acquirers make deposits in close to real-time. Others take as much as three days or longer.

Retailers can normally verify their accounts inside 24 hours of a sale and ensure that they’re scheduled to obtain the proceeds and switch them right into a separate enterprise account.

The place do acquirers get the cash to make deposits into service provider accounts? It’s through a course of known as “clearing and settlement” — a nightly reconciliation amongst issuing and buying banks that owe one another cash. Acquirers owe issuers for chargebacks; issuers owe acquirers the proceeds of the day’s gross sales.

Why can’t enterprise homeowners deposit credit score and debit card proceeds on to their checking accounts? With out separate service provider accounts, it could be tough (and a authorized nightmare) for the issuing banks and card manufacturers to withdraw funds and fines from an everyday checking account within the occasion of chargebacks or poor service provider habits.

Thus service provider accounts primarily profit the buying and issuing banks, who can maintain a service provider’s funds to guard in opposition to chargebacks and different dangers.

Forms of Service provider Accounts

Stripe is an instance of a fee facilitator, which creates one grasp service provider account after which assigns particular person companies to sub-accounts.

Whereas acquirers provide many forms of service provider accounts based mostly on threat, transaction quantity, entry to funds, and pricing, there are two main classes: devoted and aggregated (shared).

Devoted service provider accounts serve just one enterprise with one distinctive account quantity. Main suppliers of devoted service provider accounts within the U.S. embrace FIS (together with Worldpay, a latest acquisition), Chase Service provider Companies, Fiserv (previously First Knowledge), Financial institution of America Service provider Companies, and World Funds (together with TSYS, an acquisition).

Aggregated service provider account suppliers are technically fee facilitators. Examples embrace PayPal, Sq., and Stripe. Fee facilitators create one grasp service provider account with an acquirer after which assign retailers to sub-accounts. As with devoted service provider accounts, the foundations for fee facilitators are created, maintained, and enforced by the cardboard manufacturers.

Fee facilitators have turn out to be common for a couple of causes.

- Price financial savings. Fee facilitators arrange and preserve only one service provider account. The proceeds of each service provider’s transactions are deposited into this account. Fee facilitators can cross these financial savings to their service provider prospects.

- Faster approval. Purchasers of fee facilitators bear much less scrutiny and underwriting than for devoted accounts. Taking part retailers rise up and working rapidly with fewer obstacles, much less paperwork, and easier contracts.

- Easy charges. Retailers of fee facilitators are nearly all the time charged flat-rate transaction charges, that are simple to grasp and predict. The drawback is that flat-rate charges could be costlier general. (I addressed processing charges in “Half 2” of my earlier collection.)

- Fewer restrictions. Purchasers of fee facilitators usually keep away from long-term contracts and extreme early-termination charges. Retailers can take their payment-acceptance enterprise elsewhere (and rapidly), if obligatory.

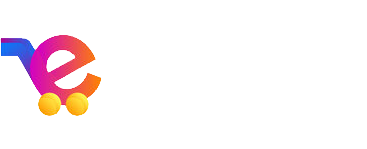

Given some great benefits of fee facilitators, why would any service provider desire a devoted service provider account? The reply has to do with charges and providers. Fee facilitators provide retailers a simple, cost-effective strategy to get began. Nevertheless, for retailers with larger transaction volumes (greater than $4,000 per 30 days, roughly), flat-rate pricing will probably be costlier than different pricing fashions, reminiscent of interchange-plus.

Listed below are some benefits of devoted service provider accounts:

- Pricing. Many devoted service provider account suppliers assist the interchange-plus pricing mannequin, which usually gives the most effective and most clear pricing for fee processing.

- Faster withdraws. The underwriting and risk-mitigation insurance policies are a lot stricter for devoted service provider accounts. Thus acquirers normally enable retailers to withdraw funds from devoted service provider accounts a lot sooner than fee facilitators — usually 2 days for devoted accounts versus 4 to seven days (normally) for fee facilitators.

- Higher service and assist, probably. One would count on that devoted service provider accounts obtain the next stage of service from the buying banks. Nevertheless, I’ve seen wonderful service from fee facilitators and horrific service from acquirers that present devoted accounts.