Editor’s Notice: That is “Half 3” of a three-part collection. “Half 1” and “Half 2” we printed beforehand.

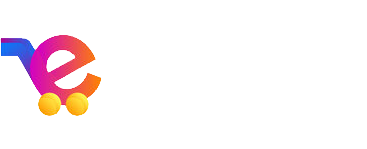

The aim of this collection is to teach retailers on questionable bank card processing charges. There aren’t any enforced requirements within the card processing trade relating to charges, charges, and contractual phrases. It’s attainable for 2 suppliers to supply seemingly the identical charges and charges that lead to totally different processing prices.

PCI Non-compliance or Non-validation Charge

Many suppliers now cost a $15 to $25 month-to-month non-compliance or non-validation price if the service provider just isn’t PCI compliant. This price could also be along with a month-to-month, quarterly, or annual PCI price. Supposedly, suppliers cost the non-compliant or non-validation price as an incentive for retailers to turn into compliant. Nonetheless, some suppliers use this price extra for income technology, than as an incentive. Some suppliers don’t cost this price in any respect.

Retailers mustn’t change suppliers due to this price. As a substitute, the retailers ought to turn into PCI compliant to remove the price and scale back the chance of being breached, which might simply lead to big financial penalties — tens of 1000’s of {dollars}. To turn into compliant, retailers ought to full the PCI Self-Evaluation Questionnaire and cling to the PCI necessities, which can require quarterly scans. Briefly, if a service provider is being charged a non-compliance or non-validation price, it’s as a lot the service provider’s fault as anybody else.

Visa FANF Charge

In 2012, Visa began charging suppliers a Fastened Acquirer Community Charge (FANF). The precise price charged by Visa relies on the service provider sort. The price for customer-present retail retailers relies on the variety of areas. For instance, a mean customer-present retail service provider with 1 to three areas will price $2.00 monthly per location if all transactions are swiped. The associated fee for an ecommerce or quick meals service provider processing $200,000 to $799,999 of Visa transactions in a given month is $120. Buyer-present retail retailers which have non-swiped transactions also can pay an extra customer-not-present FANF price.

Most aggregators — i.e., service provider account suppliers that group a number of retailers right into a single service provider account, reminiscent of Sq., PayPal — combine the FANF price into their charges and charges versus itemizing them out individually. Most conventional suppliers correctly go via the precise Visa FANF price to their retailers. Nevertheless, there are a couple of that deal with this price as one other hidden income stream. I’ve seen suppliers cost a flat month-to-month price (say $6.50) for customer-present retailers and I’ve seen the FANF price inflated by as a lot as 50 p.c for ecommerce retailers. Have in mind when reviewing that the price is mostly based mostly on the quantity of the prior month. So as phrases, the price you see in your assertion for April exercise is probably going based mostly on the March quantity, as suppliers have to know the month-to-month Visa quantity earlier than they will assess the price.

Uncommon Uncover Card Charges

For Uncover transactions, some suppliers cost the next proportion, or increased per-item price, or month-to-month entry price. Right here once more, there isn’t any justification for the upper charges or charges. The truth is, these increased charges and charges could also be in violation of the suppliers’ Uncover agreements.

Extreme Cost Gateway Charges

A cost gateway routes transactions from the service provider’s web site to the supplier. As well as, some retail point-of-sales gadgets require a gateway to route the transactions. Retailers usually pay a per-month and a per-transaction price to be used of the gateway. As a rule, the direct price to course of via the gateway is a couple of cents per transaction. That’s the direct price; each the gateway firm and the supplier produce other prices to cowl reminiscent of buyer help and overhead. Retailers ought to assessment their gateway charges together with their processing charges when analyzing their general price. A supplier providing a 5-cent transaction processing price and a 25-cent transaction gateway price just isn’t as aggressive as one providing a 10-cent transaction processing price and a 10-cent transaction gateway price, all else being equal.

Extreme Month-to-month, Annual, or Quarterly Charges

There are quite a few month-to-month, annual, or quarterly charges retailers might even see on their statements every month. Many retailers pay way over they need to for these charges. The charges could have names like “assertion price,” “service price,” “membership price,” “regulatory price,” “PCI price,” and host of different names. The truthful quantity every service provider ought to pay for these charges varies by gross sales quantity and service provider sort. Additionally, the quantity a service provider pays for any given price isn’t as necessary as the general processing price. Nevertheless, as a rule, retail customer-present retailers mustn’t pay greater than $200 per 12 months for all of those charges mixed. Ecommerce retailers mustn’t pay greater than $300 per 12 months, together with any month-to-month gateway price. These are common tips; some retailers ought to pay far much less. In case you are at the moment paying extra, it could be a very good time to assessment your general processing price together with your pricing plan, charges, and charges.

Abstract

- There’s a lack of enforced requirements and transparency within the bank card processing trade.

- Suppliers don’t use the identical guidelines when assessing charges and charges.

- When selecting a supplier, retailers ought to perceive the general processing prices, together with the supplier’s pricing plan and the way they assess their charges and charges.