I need to thank Sensible Ecommerce readers for his or her feedback on my final article collection, “Find out how to Determine Doubtful Credit score Card Processing Charges.” I additionally admire readers sending me suspicious supplier exercise, as I exploit these submissions to coach everybody.

A number of retailers despatched me their statements with suspicious charges. Among the charges have been truly reputable. However a number of have been doubtful. Worth will increase hidden within the card firm charges and inflated card corporations charges are among the many most deceptive techniques utilized by some suppliers. They use these techniques as a result of they presumably know they’ll inform the typical service provider, “It’s a Visa or MasterCard payment and we no management over it.”

Beneath are some examples I discovered from the statements retailers despatched me.

Price Improve Hidden in Evaluation Charges

Two retailers despatched the identical suspicious exercise from their supplier. Each retailers famous a rise of their evaluation charges from March to April. One of many methods Visa, MasterCard, and Uncover generate profits is by charging an assessments payment. They cost the payment to the supplier and the supplier ought to merely move the precise payment by way of to the service provider. As famous in “Half 1” of my collection in March, the assessments payment for Visa is 0.11 p.c; Uncover is 0.105 p.c; and MasterCard prices 0.11 p.c for gross sales under $1,000 and 0.13 p.c for gross sales above $1,000.

Each retailers have been charged these charges in March. Nevertheless, these charges elevated to 0.184 p.c, 0.175 p.c, 0.184 p.c, and 0.217 p.c in April. They each stated their supplier despatched a notification citing card firm modifications inflicting payment will increase. Additionally, one service provider said that she referred to as customer support personnel concerning the payment improve and felt as if the reply given was scripted.

Curiously, the mum or dad firm of this supplier was breached a pair years in the past and fined round $100 million. Regardless, there have been no current will increase to the evaluation charges and not one of the current card firm modifications justified a wholesale improve to this payment. For my part, that is merely a value improve hidden within the evaluation charges.

Inflated FANF Charge

Visa prices service provider account suppliers a Mounted Acquirer Community Charge (FANF). This payment is completely different for brick-and-mortar companies and ecommerce companies. Brick-and-mortar companies, aside from quick meals eating places, pay primarily based on the variety of areas. Ecommerce and quick meals eating places pay primarily based on their quantity. Right here once more, suppliers ought to merely pass-through the payment to the service provider. However some suppliers inflate the payment as a result of they know the service provider will imagine the rise comes from Visa.

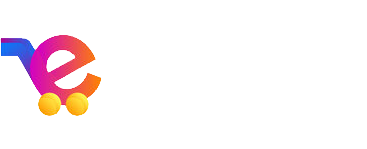

One service provider despatched me a number of statements. He didn’t know why this payment would fluctuate from $22.50 to $67.50 every month. Actually, for ecommerce retailers this payment can fluctuate month-to-month as a result of it’s primarily based on the Visa transaction quantity every month. Additionally, perceive that the payment you see on this month’s assertion is probably going primarily based on final month’s quantity.

What caught my eye was the truth that the charges weren’t entire numbers. An ecommerce service provider that processes $50 to $199 within the month might be charged $2.90. Apart from that $2.90 quantity, FANF charges are all the time entire numbers. For instance, an ecommerce service provider that processes $8,000 to $39,999 needs to be charged $15.00. An ecommerce service provider that processes $40,000 to $199,999 needs to be charged $45.00. An ecommerce service provider that processes $200,000 to $799,999 needs to be charged $120.00, and so forth.

This service provider was processing between $10,000 and $50,000 in Visa transactions every month. Due to this fact, his FANF payment ought to have been both $15.00 or $45.00 relying upon his quantity for the month. Nevertheless, the supplier was charging $22.50 and $67.50 every month — rising the FANF payment by roughly 50 p.c.

Inflated Worldwide Charges

I listed the proper worldwide payment in “Half 1” of the collection in March. The cardboard corporations assess this payment when a buyer makes use of a card issued exterior of the U.S. to buy items and companies within the U.S. For instance, Visa prices an “Int’l Service Evaluation Charge” of 0.40 p.c and a “Visa Int’l Acquirer Charge” of 0.45 p.c for most of these purchases.

However a service provider who contacted me was paying 0.90 p.c for the Int’l Service Evaluation Charge and 0.95 p.c for the Visa Int’l Acquirer Charge. The MasterCard worldwide charges have been additionally inflated. A typical service provider might imagine the inflated quantity is just not important. However it’s. This ecommerce service provider was paying as much as $10,000 per yr further due to these inflated worldwide charges.

Inflated Entry Charges

The variety of inflated card firm entry charges that I noticed is simply too quite a few to checklist. Recall that one of many methods the cardboard corporations generate profits is by charging a per-transaction payment. Visa prices an “APF” payment of 1.95 cents for bank cards and 1.55 cents for debit playing cards. MasterCard prices a 1.95 cent “NABU” and Uncover prices a 1.85 cent “Information Utilization” payment. Some suppliers present these as an “Entry payment” on the assertion versus the cardboard firm verbiage. I’ve discovered that if the time period “Entry Charge” is used as an alternative of the particular card firm verbiage there’s a larger chance (however not an absolute) that the payment is inflated. I’ve additionally seen the cardboard firm verbiage used and the payment remains to be inflated to as excessive as 10 cents.

Abstract

- Keep in mind, there are not any enforced requirements within the card processing business.

- A supplier that inflates card firm charges is an effective one to keep away from.