Two behemoths are locked in a battle for client spending and loyalty. For over twenty years Walmart dominated brick-and-mortar retail whereas Amazon dominated on-line. Now they’re on a collision course as every makes inroads into the opposite’s turf.

What follows are comparisons of their operations and techniques.

Omnichannel Promoting

Each firms have embraced omnichannel promoting. Walmart consumers can purchase on-line and have the products delivered, like Amazon. Walmart clients also can choose up a web-based order, together with groceries, in a retailer or curbside. Regardless of coming late to ecommerce, Walmart has quickly progressed, first by the acquisition of Jet.com after which by beefing up its inside operations.

Quick supply is a vital a part of ecommerce. Amazon’s speedy supply has been a aggressive benefit. Nevertheless, Walmart has added new supply choices, together with the shop pickup if wanted instantly.

Amazon’s first foray into brick-and-mortar began with bookstores after which small-format cashier-less grocery shops (Amazon Go). It then acquired Complete Meals Market.

Amazon Go is a cashier-less grocery and comfort retailer, reminiscent of this instance in Seattle.

Bodily Shops

In 2021 Walmart had 11,443 shops worldwide, a lower from the 11,501 it had in 2020, in line with Statista. Within the U.S., there are 5,342 Walmart shops and 600 Sam’s Golf equipment. Ninety % of Individuals stay inside 10 miles of a Walmart retailer.

Amazon believes it has to compete with Walmart on the brick-and-mortar entrance past groceries. In response to an August 2021 Wall Road Journal article, Amazon intends to open bodily retail shops within the U.S. of roughly 30,000 sq. ft. That measurement is lower than one-third that of Walmart’s standard shops and one-sixth the dimensions of Walmart Supercenter shops.

The primary Amazon shops are slated for Ohio and California and are anticipated to showcase the corporate’s private-label items — clothes, furnishings, and client electronics. In early 2020 Amazon opened its first Amazon Go in Seattle. In March 2021, it opened its first bodily retailer outdoors North America, an Amazon Recent grocery in London. Since then it has opened 5 extra shops in England.

At present, Amazon’s U.S. bodily shops embrace 503 Complete Meals Markets, 12 Amazon Recent grocery shops, two Amazon Go Grocery shops, 22 Amazon Go comfort shops, 24 Amazon Books shops, and 30 Amazon 4-Star shops, which promote items rated 4-stars and above on-line in addition to trending gadgets and high on-line sellers.

Whereas Amazon will presumably by no means rival Walmart within the brick-and-mortar area, bodily shops can accommodate clients who want to choose up or return on-line orders in particular person.

Supply

Walmart is bolstering its supply service to raised compete with Amazon. Earlier this month Walmart introduced plans to rent greater than 3,000 U.S. supply drivers and construct a fleet of all-electric supply vans to help its InHome grocery supply service, which lets drivers entry clients’ properties through a wise lock and place groceries purchased on-line in fridges.

First launched in fall 2019, the service is now out there to six million households throughout the U.S. Walmart says it plans to increase InHome supply to 30 million U.S. properties by late 2022. The InHome service prices $19.95 monthly. Walmart introduced a partnership with electrical automobile and repair supplier BrightDrop, the Common Motors subsidiary, for five,000 vans. This may rival Amazon’s Supply Service Accomplice Program, which makes use of a third-party community for last-mile deliveries.

Walmart will buy 5,000 electrical vans from BrightDrop.

Walmart’s common Specific supply permits clients who purchase on-line to order a two-hour home-delivery slot for groceries, pet provides, and a few electronics.

Members of the Walmart+ loyalty program get free supply. For different clients, a $35 order is required.

Obtainable in additional than 600 cities, Walmart’s Spark Driver is a program whereby clients place a web-based order, and impartial third-party contractors do the purchasing and supply.

In August 2021 Walmart created a brand new line of enterprise — Walmart GoLocal — a white-label last-mile supply service for firms with massive merchandise or advanced necessities. Residence Depot is a buyer.

Workers

Walmart has 2.3 million workers worldwide — with over 1.6 million within the U.S., together with these at Sam’s Membership. Walmart is the most important U.S. private-sector employer.

For a few years Walmart employed principally part-time hourly employees who acquired no advantages and earned just a few {dollars} above the federal minimal wage. Walmart is now shifting 67% (two-thirds) of its U.S. physical-store hourly jobs full-time. Whereas that’s up from 53% 5 years in the past, it’s nonetheless beneath the 71% common for the U.S. retail and wholesale business.

Amazon has nearly 1.5 million workers worldwide, with 170,000 added within the first 9 months of 2021. The corporate has important worker churn. In 2019 Amazon employed greater than 770,000 hourly employees. John Phillips, the previous Amazon world head of workforce hiring, wrote on LinkedIn that 620,000 resigned or have been fired.

Wages

Walmart has lengthy lagged its brick-and-mortar rivals in worker wages and advantages. The Covid pandemic prompted mass employee resignations, pressuring all retailers to extend wages.

In September 2021 Walmart raised its minimal beginning wage to $12 an hour from $11 and elevated all U.S. employees’ pay by $1 an hour. That was the third wage hike in 2021. The common wage for hourly employees at Walmart is now $16.40. In distinction, Costco raised its beginning hourly fee from $15 in 2019 to $16 in 2020 and $17 in October 2021. Costco’s common pay for hourly employees is $24 per hour. Goal’s beginning minimal wage is $15 an hour.

Amazon’s entry-level hourly fee is $16, however in September 2021 it raised the speed for warehouse employees to $18 an hour or larger, relying on the situation. Amazon does present a beneficiant advantages bundle.

Financials

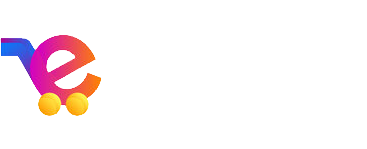

In response to Statista, Amazon’s estimated 2021 ecommerce income was $367 billion versus Walmart’s estimated $75 billion, up from $40 billion in 2020.

In response to information and software program supplier FactSet, Amazon’s ecommerce gross sales (together with these of third-party market sellers) surpassed Walmart’s complete gross sales (on-line and brick-and-mortar) within the twelve months ended June 30, 2021. In that interval, Amazon raked in $610 billion from customers. Compared, Walmart took in $566 billion, marking the primary time it has been outsold since 1990, after which it dethroned Sears as the most important American retailer.