The digital funds trade is notoriously complicated. This put up is the ultimate installment of a 2-part sequence on service provider accounts, that are required for all companies that settle for bank cards. “Half 1” described the aim of such accounts.

I’ll deal with on this article service provider account suppliers and the position of unbiased gross sales organizations. I’ll additionally provide ideas for selecting the right supplier for what you are promoting.

All of this follows my 3-part “Credit score Card Processing FAQs” sequence, during which I defined trade jargon, pricing fashions, and costs.

Card Manufacturers

Recall from “Half 1” that “acquirer,” “service provider account supplier,” “service provider acquirer,” and “buying financial institution” check with the identical factor: a monetary establishment that has been registered and authorised by a number of of the cardboard manufacturers (Visa, Mastercard, Uncover, American Specific) to just accept card funds on behalf of a service provider.

Playing cards manufacturers govern the enterprise of buying. Their position is big. Acquirers should adjust to the manufacturers’ guidelines and rules. Fortunately, the manufacturers compete to register and retain acquirers.

Card manufacturers — American Specific, Mastercard, Visa, and Uncover — set guidelines and rules for suppliers of service provider accounts.

The cardboard manufacturers cost licensing, utility, and membership charges. Different service provider account roles of manufacturers embody:

- Guidelines and rules. The manufacturers create, modify, and publish the foundations for the buying trade.

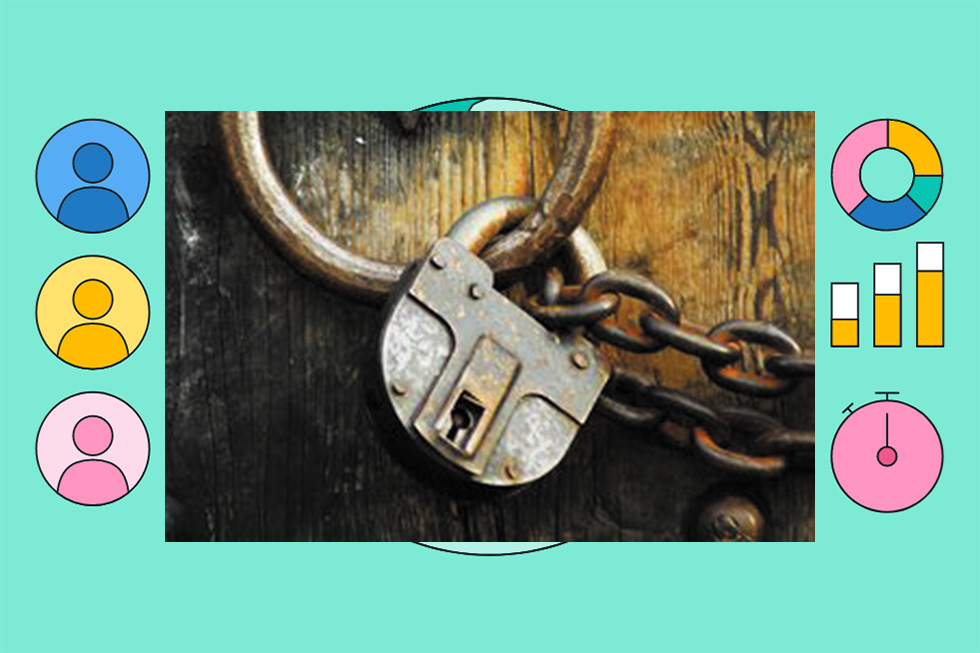

- Safety. The trade will depend on defending delicate card information and private info. Lots of the guidelines for acquirers concern safety. Amongst different measures, acquirers, together with their companions and subcontractors, should adjust to PCI-DSS.

- Expertise. Card manufacturers have created digital techniques that permit acquirers to obtain, route, and safe fee transactions. This consists of, for instance, providers that encrypt and securely retailer card information. Different providers embody fraud prevention, transaction routing, information storage, and enterprise intelligence (information and analytics).

- Compliance. The manufacturers police their very own buying networks, with frequent audits to make sure compliance with the foundations. Offenders can lose their buying licenses, though it’s rather more frequent for the cardboard model to levy a advantageous and assist the acquirer turn out to be compliant. I’ve seen a card model waive, normally briefly, a number of of its guidelines for an acquirer. This usually happens when an acquirer wants extra time to implement a brand new process, equivalent to PCI.

Third Events

Understanding the service provider account wants of each kind of enterprise is a near-impossible process, even for the biggest banks, who don’t usually have specialised experience. Consequently, buying banks depend on third-party suppliers.

What follows are frequent third-parties.

- Unbiased gross sales group. An ISO is an organization that markets buying providers to retailers on behalf of an buying financial institution. An ISO is just like an unbiased insurance coverage company. The ISO will tailor a spread of payment-acceptance providers for retailers and can obtain a fee — normally a one-time charge or a share of the income generated — from the buying financial institution and fee processor. ISOs can promote the providers of many alternative acquirers, choosing and selecting the very best match for the service provider. Much less respected ISOs promote the providers that supply the very best commissions or charges as an alternative of the most suitable choice for the service provider. ISOs are usually consultants in a selected trade. Some fee processors additionally function as ISOs — the processor sells on behalf of an buying financial institution. Some ISOs name themselves acquirers.

- Member service supplier. MSP is Mastercard’s title for ISO.

- Third-party agent. TPA is Visa’s title for ISO.

- Worth-added reseller. A VAR integrates the expertise of third-parties right into a single product or provide. An instance is integrating fee gateways into point-of-sale gear. VARs are usually not acquirers, however they could function like ISOs or personal ISO companies.

- Referral brokers. Some acquirers and ISOs provide referral charges to brokers, who will be ISOs however are normally unrelated to fee processing, equivalent to accounting companies. In contrast to ISOs, referral brokers wouldn’t have to register with the cardboard manufacturers. Thus referral brokers can not name themselves acquirers or use Visa or Mastercard’s branding. In addition they can not carry out the features of an acquirer.

Monitoring ISOs

The cardboard manufacturers have strict guidelines for ISOs. An ISO should register with every card model and with every acquirer that it represents. ISOs pay sign-up and annual charges to the cardboard manufacturers, who audit ISOs yearly for branding and different compliance guidelines.

The cardboard manufacturers have strict guidelines for ISOs.

The cardboard manufacturers maintain acquirers accountable for the habits of ISOs. If an ISO brings a fraudulent service provider into the fee community, the acquirer is accountable. If a service provider signed by an ISO incurs chargebacks, the acquirer refunds the issuer. If an ISO’s service provider accepts funds however doesn’t fulfill orders, the acquirer remediates. Thus acquirers choose, underwrite, audit, and monitor their ISOs fastidiously.

Service provider buying generally is a dangerous enterprise for the next causes.

- Chargebacks. A chargeback is a transaction reversal when a cardholder claims that he didn’t make a purchase order. The issuing financial institution will return the cardholder’s cash nearly instantly and file a declare towards the service provider’s acquirer.

Based on the foundations, the acquirer should first refund the issuer (which has already refunded the cardholder). Solely after the refund happens can the service provider and its acquirer dispute the method. Regardless, the acquirer will take away the funds from the service provider’s service provider account — no questions requested — plus a hefty chargeback charge. When a service provider is unable to refund chargebacks, the acquirer should cowl the fees. In brief, acquirers (not retailers) management service provider accounts.

- Fund reversals. A fund reversal is a refund (or partial refund) granted to the shopper by the service provider. As a result of the buying financial institution deposits funds within the service provider’s service provider account, typically earlier than the expiration of product warranties and ensures, acquirers are uncovered to the danger {that a} service provider will refuse to refund clients (leading to chargebacks) or the danger {that a} service provider will exit of enterprise earlier than refunding its clients. In each instances, the acquirer is accountable for chargebacks if the service provider can not carry out.

- Service provider solvency. Retailers that exit of enterprise (i) can not pay their service provider account charges, (ii) can not cowl chargebacks, and (iii) may fail to return an acquirer’s point-of-sale gear.

- Service provider fraud. Retailers that have interaction in fraud expose acquirers to (i) chargebacks, as defined above, (ii) fines and different penalties levied by the cardboard manufacturers, and (iii) reputational injury to the acquirer and the manufacturers.

How Acquirers Make Cash

The first income for acquirers are service provider account charges, fines, and miscellaneous income from fee processors and different value-added suppliers. Acquirers don’t obtain interchange charges, which is income for the issuing banks.

Income from retailers consists of charges for:

- Registration,

- Account setup, upkeep, and closure,

- Assist and repair,

- Foreign money conversion,

- Chargebacks and chargeback disputes,

- Audits,

- PCI compliance,

- Settlement, also referred to as batch or every day batch,

- Month-to-month minimums.

Buying banks can generate further income by partnering with processors to supply each service provider accounts and fee processing options. Some acquirers, normally the biggest banks (e.g., Chase, Citi), have inside departments for buying, issuing, and processing.

Deciding on a Service provider Account Supplier

Service provider buying is extremely aggressive. Pricing and contractual phrases differ amongst suppliers. Contemplate these tricks to discover the very best supplier for what you are promoting.

- Know the small print. Be sure that the salesperson is disclosing the entire prices and restrictions, equivalent to (i) all charges and penalties, (ii) the corporate’s coverage for holds and reserves, (iii) when to switch funds out of the service provider account, (iv) procedures should you’re not glad, (v) month-to-month minimal charges or different hidden charges, and (vi) the size of the contract and the early termination charges.

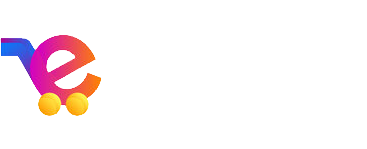

- Perceive your processing quantity (every day, month-to-month, yearly) earlier than negotiating. Understanding your transaction quantity will assist decide whether or not you want a devoted service provider account or an mixture account, equivalent to Stripe, Sq., PayPal. The kind of account will dictate your fee processing charges as devoted accounts permit inexpensive interchange-plus pricing.

- Perceive what you are promoting’s danger profile. Take steps to scale back chargebacks. Acquirers don’t like danger. For those who function in a high-risk trade, assist your acquirer perceive how you intend to scale back its publicity. Excessive-risk companies can count on to pay larger charges or incur bigger holds. Ask the acquirer if it may possibly assist keep away from fraudulent funds.

- Ask about reductions from potential acquirers should you use their fee processing providers or their companions’ providers.

- Integration. Affirm {that a} potential acquirer can combine with what you are promoting’s buyer and accounting techniques. Inquire as to the problem and the fee. Typically acquirers will take in that value.