That is the primary article in a 2-part sequence on frequent errors I see retailers make when negotiating charges and costs or analyzing the gives from completely different credit-card-processing suppliers.

Credit score-card-processing Negotiating Errors

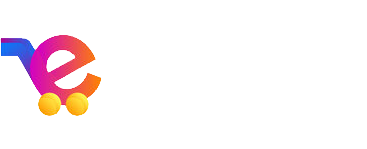

1. Retailers assume the terminology utilized by competing salespeople is identical. Two salespeople can provide the identical fee — say 0.10 p.c + $0.10 over interchange charges and pass-through charges. That is referred to as “interchange plus” pricing. Regardless of providing the identical fee and the identical charges, supplier A can value the service provider hundreds of {dollars} extra per 12 months than supplier B.

The reason being that there are not any enforced business requirements on the definition of “interchange-plus pricing.” When some salespeople say “interchange plus,” they imply the markup they’re providing (say 0.10 p.c + $0.10) is along with the interchange charges and costs printed by the cardboard corporations — Visa, MasterCard, American Categorical, Uncover. That is the definition I counsel retailers to make use of.

Nevertheless, when different salespeople say “interchange plus,” it signifies that their markup is added to the interchange charges and solely a portion of the charges charged by the cardboard corporations. Different charges charged by the cardboard corporations may be inflated by the supplier above the mounted “markup.”

… there are not any enforced business requirements on the definition of “interchange-plus pricing.”

Furthermore, one other salesperson might say “interchange plus” and it means the charges charged by the cardboard corporations are handed via to the service provider however the interchange charges may be topic to surcharges by the supplier. Nonetheless different salespeople might say “interchange plus” after which cost seemingly random charges — not charged by card corporations — like “Visa Dealing with Charge.” These charges seem like card firm charges however are literally surcharges by the supplier.

The identical lack of requirements additionally applies to tiered pricing plans. There are a lot of variations of tiered pricing. Nevertheless, the most typical is the 3-tier plan, with tier 1 being the Certified fee, tier 2 being the Mid-qualified fee, and tier 3 being the Non-qualified fee.

Two salespeople can provide what appears to be the identical 3-tiered pricing plan — say a Certified fee of 1.5 p.c, a Mid-qualified fee of two.5 p.c, and a Non-qualified fee of three.5 p.c. Nevertheless, Supplier A can value the service provider hundreds of {dollars} extra per 12 months than Supplier B as a result of there are not any enforced requirements that outline the cardboard sorts in every tier.

For instance, a regulated debit card (i.e., a debit card issued by a big financial institution and topic to most interchange charges) might be within the Certified fee for one supplier and within the Non-qualified fee for the opposite supplier. Additionally, one plan might embody the cardboard firm charges within the tiered charges and the opposite might not.

I point out the tiered fee plan solely for example pricing discrepancies. In truth, I dislike tiered pricing. I imagine it exists to profit suppliers, not retailers.

2. Retailers don’t absolutely perceive the price to exit the contract. By no means signal a contract or pricing addendum till you have got the phrases and situations in your palms (phrases and situations are typically in a separate doc and never on the contract) and also you absolutely perceive the most penalty for terminating the contract early. Truly learn the termination coverage versus simply asking the salesperson. Most salespeople have by no means learn their very own phrases and situations and people representing suppliers with very punitive early-termination fese might unknowingly miscommunicate the details.

Many suppliers shouldn’t have an early termination payment. They imagine that their processing value and repair will keep the service provider relationship. Different suppliers might have a set early termination payment of, say, $250. In lots of circumstances, a supplier will waive such a termination payment, though the salesperson could also be reluctant to supply the waiver as he might lose his bonus or fee.

By no means signal a contract or pricing addendum till you have got the phrases and situations in your palms…

Essentially the most punitive sort of termination payment is the one with a liquidated damages clause. This varies by supplier, however it might learn one thing like this: “Service provider agrees to pay the higher of $500 or 50% of the typical month-to-month processing charges paid by the service provider instances the months remaining on the contract.” Sadly, many retailers discover out the onerous approach that exiting the contract or pricing addendum early will value them hundreds of {dollars}

Retailers ought to keep away from suppliers with contracts that embody liquidated damages on early termination.

Retailers also needs to know the size of the contract, the renewal coverage, if termination is required in writing, and the minimal variety of days (typically 30 to 90) earlier than the expiration date by which the termination discover have to be given to keep away from a penalty.

3. “Match the speed” doesn’t imply “match the price.” Retailers usually obtain a suggestion from a competing salesperson after which ask their present supplier to match that supply. It’s a observe I don’t like as a result of the competing salesperson might have spent an excessive amount of money and time to place forth an earnest financial savings evaluation solely to have the service provider use it for his personal profit.

“Match the speed” doesn’t imply “match the price.”

I additionally don’t like this observe as a result of it may be considerably of a recreation for the present supplier, particularly when the service provider is presently on a tiered pricing plan and desires the supplier to match salesperson’s interchange plus pricing.

Asking the present supplier to match the speed is a foul observe for all the explanations talked about in level 1., above. It’s additionally a foul observe as a result of many suppliers surreptitiously add charges and costs to the brand new interchange plus pricing that had been supposedly included within the tiered pricing.

See the second installment, at “Half 2: Understanding the Supply.”