The pandemic-induced shift to on-line and contactless funds has been a boon for bank card suppliers and their gross sales brokers. The business depends upon these brokers, referred to as “impartial gross sales organizations” — ISOs — to market cost providers to companies.

On this put up, I’ll look at the position of ISOs. Understanding how ISOs function will assist retailers safe one of the best cost processing.

This follows from my 3-part collection on bank card processing, which explains the individuals and pricing strategies and presents money-saving recommendations. My 2-part primer on service provider accounts addresses their function and tips on how to choose one of the best supplier.

Why ISOs?

Buying banks and cost processors depend on ISOs to promote their providers. A great ISO will use its expertise in an business to tailor options for retailers. ISOs focusing on cost processing for eating places are an instance.

ISOs can promote the providers of many service provider acquirers and cost processors, selecting and selecting one of the best answer for a service provider. ISOs are just like impartial insurance coverage businesses that discover one of the best insurance policies for his or her shoppers.

ISOs are supposed to grasp the circumstances of their service provider shoppers and suggest appropriate options, akin to pricing, gear, and know-how. One of the best ISOs take the time to grasp their shoppers and construct long-term relationships.

ISOs should register with the cardboard manufacturers — Visa, Mastercard, American Categorical, Uncover. Registration charges are roughly $5,000 per 12 months, per model. ISOs continuously have their very own brokers, who would not have to register.

ISOs vary in dimension. Some are enormous, with a whole lot of brokers and workers; others are small, with just some workers and even one worker. Bigger ISOs generally subcontract elements of their enterprise to smaller ISOs. So as to add to the confusion, Visa and Mastercard don’t use the acronym ISO. As a substitute, Mastercard makes use of MSP (member service supplier), and Visa makes use of TPA (third-party agent).

How ISOs Make Cash

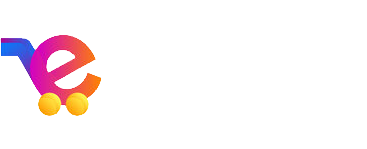

Understanding how ISOs are compensated will assist retailers obtain one of the best pricing and providers. ISO income comes from:

- Residuals, that are a proportion of the charges that retailers pay for cost processing. Each time a service provider accepts a cost, the ISO receives a residual. Residuals are the first income supply for many ISOs.

- Worth-added upselling, that are commissions from promoting further providers, akin to fraud verification, enhanced reporting, and point-of-sale equipment.

- Bonuses from new sign-ups, which might vary from $400 to $5,000 per service provider.

- Promoting portfolios. ISOs can promote their service provider portfolios to non-public traders or different ISOs. The value depends upon potential residuals. Retailers ought to examine their agreements rigorously to make sure that pricing and repair ranges don’t change if their account is bought.

ISOs: Good vs. Dangerous

I’ve labored within the funds business for roughly 20 years. Most ISOs and their brokers are sincere, hard-working specialists who need their service provider shoppers to succeed. Sadly, a couple of usually are not.

Good ISOs:

- Evaluation service provider statements continuously, searching for methods to scale back charges.

- Present experience based mostly on the service provider’s business.

- Promote services and products that assist the service provider, no matter residuals and bonuses.

- Proactively assist retailers.

- Clarify their contracts intimately, guaranteeing the service provider understands the phrases.

Dangerous ISOs:

- Use aggressive, high-pressure gross sales techniques.

- Don’t clarify the charges, service ranges, and phrases and circumstances.

- Promote pointless providers and gear.

- Disappear after the contract is signed.

Suggestions for Retailers

When coping with ISOs:

- Perceive the charges. I’ve seen charges that begin low however improve over time and different bait-and-switch gross sales techniques.

- Do not forget that ISOs and their brokers depend on residuals and bonuses. Be sure an ISO-recommended product is sweet for your enterprise.

- Evaluation the contract rigorously and retain the ultimate, executed copy.

- Ask as many questions as essential. There are not any silly questions. A great salesperson will reply professionally and politely.

- Inquire whether or not the ISO intends to promote your account. Perceive your rights if that happens.

- Examine the supply to different ISOs.

- Acknowledge that an ISO might not match your enterprise. Furthermore, smaller ecommerce operations, micro-merchants, and occasional sellers possible won’t profit from an ISO and can be higher off counting on end-to-end service suppliers akin to PayPal, Sq., and different peer-to-peer providers.