Digital currencies have the potential to develop ecommerce, decrease transaction charges, remove chargebacks, and forestall fraud. Up to now, nonetheless, volatility and its worry have stopped most retailers and types from accepting cryptocurrencies. However this might be altering.

Stablecoin and central financial institution digital currencies might be non-volatile choices. Stablecoins are tied to reference belongings reminiscent of fiat currencies (i.e., U.S. greenback, euro), commodities, or techniques that management the availability. In all circumstances, stablecoin’s worth is predictable.

Central financial institution digital currencies (CBDCs) are government-managed. These digital currencies ought to, in idea, be as steady as any government-backed cash.

Extending Ecommerce

Cryptocurrencies ought to enhance ecommerce. There are lots of unknowns, however conceptually the advantages exist.

For instance, a cryptocurrency may prolong ecommerce to “unbanked” communities worldwide.

In 2017, the World Financial institution estimated that 1.7 billion folks worldwide — 31% of adults — didn’t have a checking account.

In accordance with a Federal Deposit Insurance coverage Company 2019 survey, about 5.4% of American households didn’t have an account with a financial institution.

One cause for this might be the expense. Low-income adults generally pay $140 a yr or extra within the U.S. to open a checking account. By comparability, account holders with extra funds sometimes pay nothing.

U.S. households described as “coping” or “weak” collectively paid $23.7 billion in financial institution charges in 2020, based on a report by analysis agency Monetary Well being Community.

People with out entry to a checking account can’t sometimes acquire a cost card, limiting their entry to ecommerce.

Cryptocurrencies bypass conventional banks. Thus digital cash might prolong ecommerce to customers who may gain advantage from shopping for on-line.

Unbanked customers are primarily poor or what the Monetary Well being Community described as weak. Nonetheless, entry might open new alternatives for them, and collectively they symbolize a big new marketplace for ecommerce.

Low-cost Ecommerce

Cryptocurrency advocates are fast to notice the present cost system — credit score and debit playing cards, primarily — isn’t low-cost or environment friendly. Those self same advocates may add that digital {dollars} ought to be a major enchancment.

Right here once more, there are numerous unknown parts, however retailers and types might make more cash. For banks, the alternative can be true.

Many retailers incur cost processing charges of two.5% or extra. The varied banks and establishments that facilitate ecommerce transactions pocket these charges — yearly greater than $100 billion worldwide.

The blockchain expertise underlying cryptocurrency connects customers and retailers straight. There are not any intermediaries in lots of, if not most, circumstances apart from exchanges and infrastructure.

Charges, if any, may quantity to fractions of a share level. Banks and cost card corporations would want to seek out new methods to earn charges, however retailers must be higher off.

If all customers switched to cryptocurrency, retailers might earn maybe 2% or 3% extra in gross margin. A enterprise with $10 million in annual income may see revenue rise by $200,000.

Main retailers and types acknowledge even now how costly cost card processing charges are. In some jurisdictions, Amazon and Walmart have launched a surcharge for purchasers who pay with Visa due to its charges.

Fraudless Ecommerce

One must be cautious to underestimate crooks. Fraudsters are ingenious, reportedly stealing upwards of $20 billion in 2020 because of the porous state of cost card safety.

Service provider service corporations and cost card issuers don’t do sufficient to cease fraud, passing the price burden on to retailers and types.

Right here too, stablecoin and CBDCs may assist. Whereas fraudsters could but uncover methods to revenue from nefarious ecommerce transactions, the blockchain ledger ought to make it comparatively harder.

Fund verification, for instance, is healthier and extra correct with digital currencies on a blockchain than with the present cost system. Ecommerce retailers might count on dramatically fewer fraud losses if all transactions transfer from cost playing cards to stablecoin or CBDCs.

Chargebacks would presumably be nonexistent since there isn’t a middleman between the client and vendor.

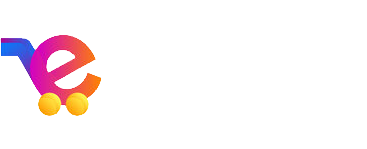

Consideration and Adoption

Stablecoin and CBDC transactions must be quick. Verification must be correct. Bank card fraud ought to now not exist. Chargebacks ought to stop. All the ecommerce cost course of must be higher with steady cryptocurrency.

There are lots of unknowns. However blockchain currencies reminiscent of stablecoins and CBDCs have the potential to develop and enhance ecommerce.

Terra, for instance, is a comparatively new stablecoin. Though personal, Terra carefully controls its worth by adjusting the availability, very like the U.S. Federal Reserve and different central banks.

A number of retailers in Southeast Asia have already adopted Terra. As extra retailers settle for it or comparable stablecoins, customers ought to change into extra comfy protecting and holding stablecoins for ecommerce.